No More Getting Denied For Auto Loans, Apartments, Credit Cards, Mortgage Loans, and Anything Else You Desire! Live the Life your Deserve and

FIX YOUR CREDIT

BE HONEST...ASK YOURSELF THESE QUESTIONS!

- Are you tired of always needing a Co-Signer just to qualify for something?

- Do you even WANT to fix your credit?

- Why haven't you invested in yourself to fix your credit?

- ENOUGH IS ENOUGH! CHANGE YOUR CIRCUMSTANCES TODAY!

*IMPORTANT*

If your answer is "YES" to any of these questions, then GOOD FOR YOU!

Now is the time to TAKE CONTROL of your credit, IMPROVE your score,

and REACH YOUR GOALS.

WHAT YOU WILL GET?

CLEAN UP YOUR PAST

We work with the credit bureaus and your creditors to challenge the negative reporting items that affect your credit score.

TRACK YOUR PRESENT

Easy access to your account 24/7 for live status updates on improvements on your credit reports and scores.

CHANGE YOUR FUTURE

We’ll educate you about credit so you can achieve your goals and learn how to maintain your awesome credit long after our work is done.

HOW DOES IT WORKS?

"Establishing Good Credit is Essential to getting the most out of life!"

Signup

Schedule your phone consultation with a us to discuss the best options for you.

Relax

We will analysis your credit and create a personalized strategy to challenge negative items on your report

See Results

You will have access to log in to see real time progress every step of the way

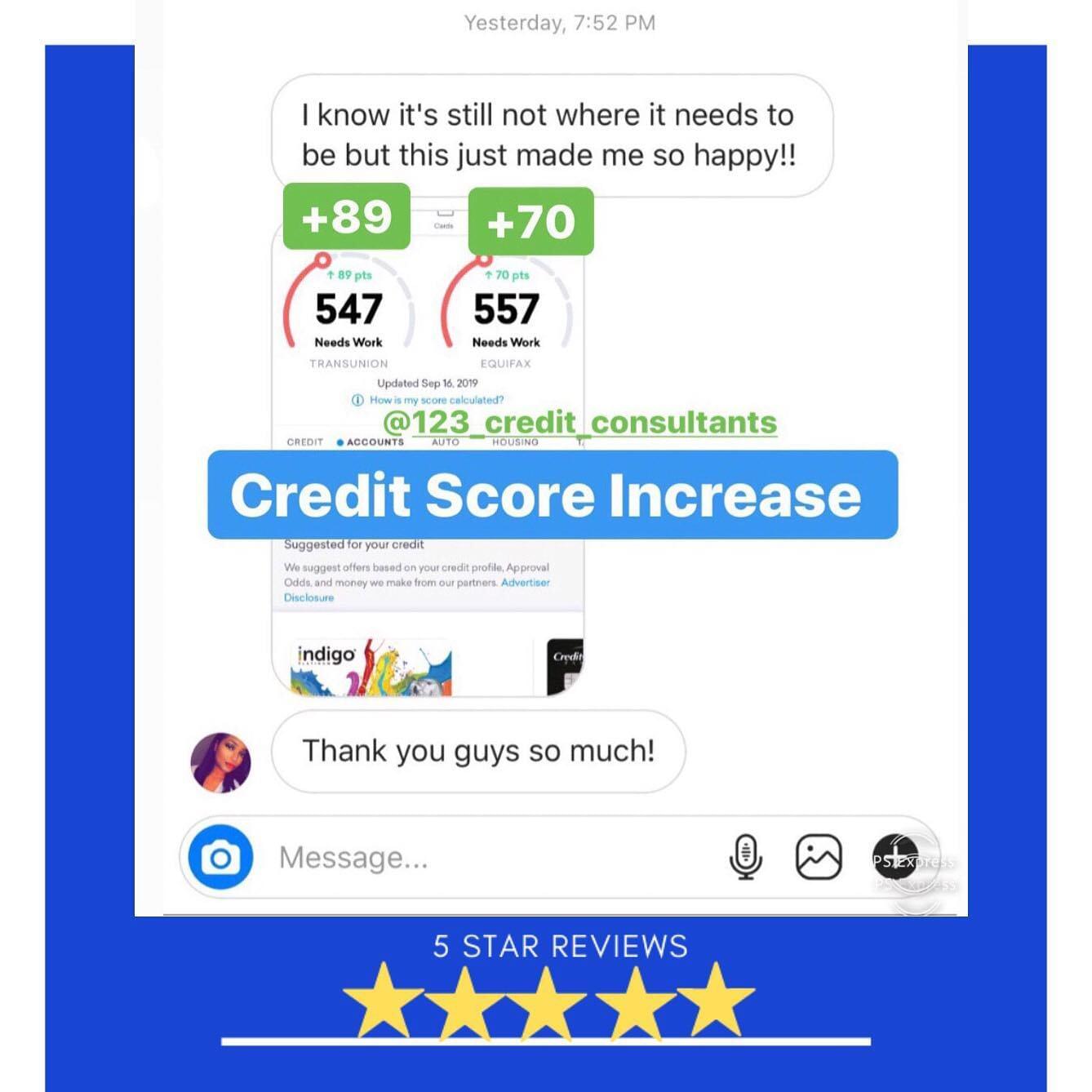

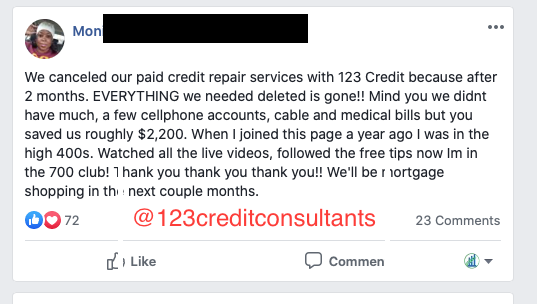

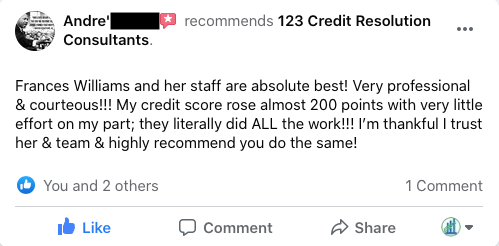

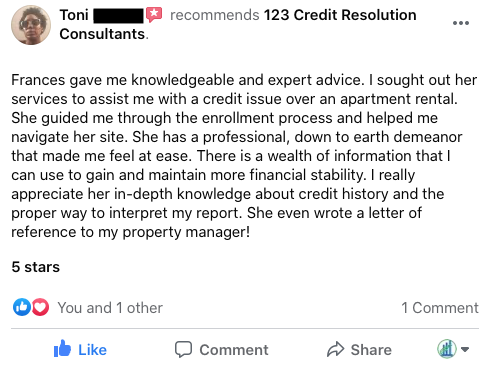

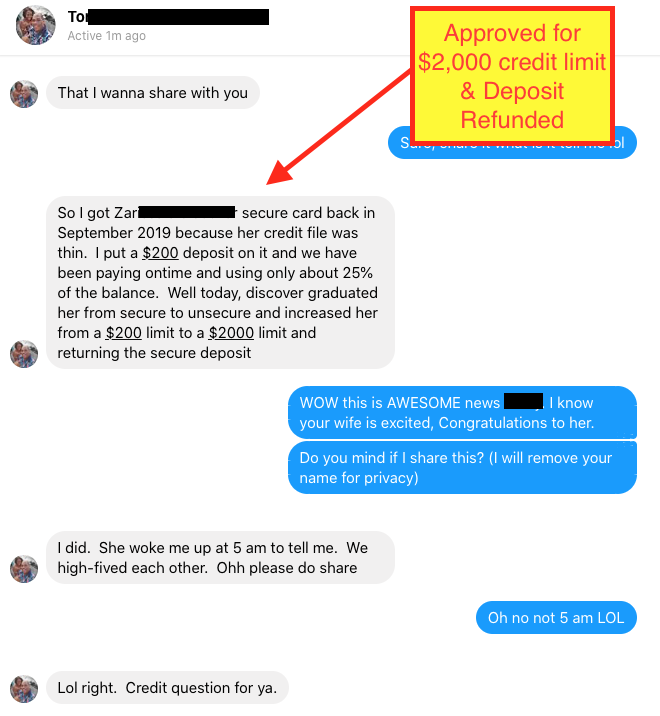

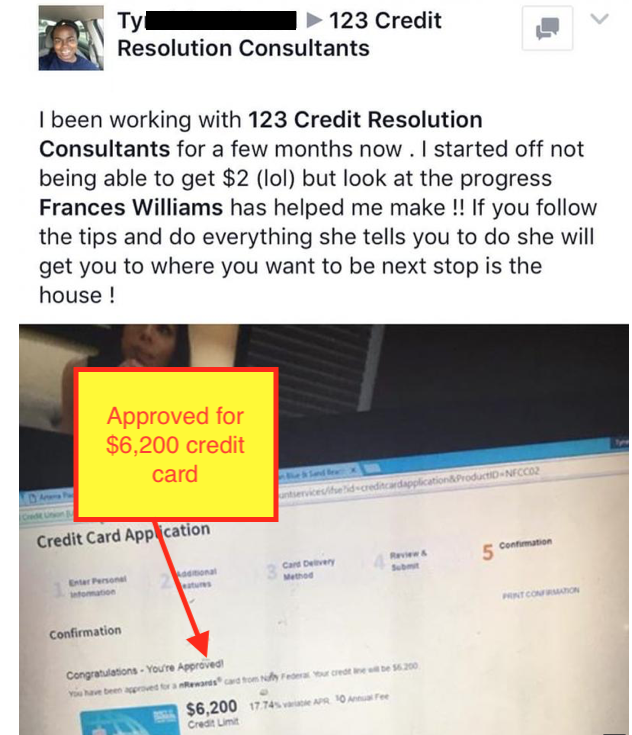

DON'T JUST TAKE OUR WORD FOR IT...

REAL RESULTS!

To sweeten the deal we offer a 120 Day Money Back Guarantee. If you do not see any results on your credit after 90 days of consecutive services, we will issue a full refund of the service level fees no questions asked!

OUR SERVICES

50% off Enrollment Fee

Now >>> 50% OFF

limited time Offer

00Hours00Minutes00Seconds

We offer affordable payment options for one set price regardless of the amount of accounts on your credit report and the amount of debt you are in. All of our price packages are month to month without a contract. You can cancel anytime without any cancelation fees.

Gold Service Package

Limited Time:

50% OFF Enrollment Fee

of $499.98

One time enrollment fee $299.99 per person

Monthly fee - $199.99 per month (charged 30 days after service has been rendered)

-

Includes everything in the premium service level plus:

-

Disputes Sent Certified Mail

-

Debt Settlement/Negotiation

-

One-on-One Private Phone Consultations with a Credit Consultant

Most Popular

Premium Service Package

Monthly fee- $119.99 per month (charged 30 days after service has been rendered)

-

Unlimited Email Support

-

Unlimited Credit Bureau Disputes

-

Unlimited Creditor Disputes

-

Detailed Credit Report Review & Credit Report Analysis Report

-

24/7 Progress Report Updates

-

Text Message Updates and Alerts

-

Financial Coaching to help you save, budget, pay down debt, buy a home, and build business credit.

-

One-on-One Private Phone Consultations with a Credit Consultant

One-Time Credit Consultation

One time Consult fee - $99.99 per person

No Monthly Cost - Phone consultation includes 20 minute phone consultation with a credit consultant

- Detailed Credit Report Review

- One 20-minute Private Phone Consultations with Credit Consultant

-

Credit Report Analysis Report w/ Credit Improvement Recommendations

-

Recommendation on Which Service Level to Enroll In

WHAT YOU CAN EXPECT FROM US

- Start seeing within results in 60 days

- Monthly in-depth credit analysis

- No Hidden Fees

- Unlimited Credit Bureau Disputes

- Unlimited Email Support

- No Cancellation Fees

How Does The Billing

Process Work?

FAQ

CUSTOM JAVASCRIPT / HTML